Hello finance professionals! Today let’s talk about why Convertible Bonds are once again picking up steam as a popular investing choice for institutional investors, venture capitalists and equity investors.

Amidst the volatile markets of the pandemic, a huge number of start-ups and companies with a cash-crunch found that raising money through hybrid instruments like convertible bonds was a more lucrative choice compared to traditional equity or debt. And the numbers don’t lie. In the year 2020, more than $188 billion in convertible bonds were issued worldwide.

Interestingly, the last time the world saw such a surge in popularity of convertible bonds was way back in 2008 (during another time of global uncertainty), when the amount of convertible debt issued was more than $86 billion.

To understand the business advantages of issuing convertible bonds, let’s take the example of Southwest Airlines.

Southwest Airlines offers customers the flexibility of high-speed transport with frequent and flexible departures at low-cost prices, focusing on friendly service, speed, and frequent point-to-point departures; without incurring extra costs in providing meals and lounge service.

In this way, they managed to become the country’s largest domestic air carrier, capturing more than 25% share of the domestic air travel market in the US, with this strategy that has proved effective for almost 5 decades.

When global travel was halted in April 2020, Southwest issued $2.3 billion 1.25% convertible note (due in 2025), to help the company with an influx of cash which would help it tide uncertain times. The conversion price was set at $38.48 per share.

Note: the market price of the share around that time was approximately $28. As of 16 November 2021, the share price was hovering around $48.

Why are convertible bonds so popular during volatile times?

For Companies: – Lower revenues due to imposed lockdowns and travel restrictions – Uncertain times lead to higher cash flow burn rates – Liquidity crunches faced in difficult times – Effective way of raising capital for start-ups and unproven businesses that are in capital-draining businesses – Ownership is not immediately diluted, unlike an issue of equity – The interest rate offered can be lower as compared to an out-and-out bond since investors are provided with the equity upside | For Investors: – Those who expect the company to do well and make a healthy turn-around, find convertible debt to be an attractive option. – Such a “recovery type trade” or “rescue finance” invariably offers more equity upside: the option to convert into stock once the stock prices bounce back is more valuable than redeeming the value in cash. – The stock option within a convertible debt is always priced at the mid-point, reflecting both: the demand for the convertible instrument, the recovery potential of the company as well as taking cognizance of the current market situation |

Thus to put it simply, convertible Debentures offer the advantages of equity while negating the risk of uncertainty with its bond-like features.

It enables investors to be a part of the growth or turnaround story of the company without the inherent risks of traditional equity investing.

More about the Instrument: Convertible Debt

Just like any other debt or bond, convertible debentures are issued with a fixed coupon rate, a maturity date, and a redemption value. They also include a conversion option (at the option of the holder or the issuer) which allows an exchange of a certain number of shares of the issuer’s company at the time of redemption of debentures instead of cash.

When will the bonds convert (and how will an investor gain from it)?

The conversion price of the convertible bond at the time of its issue is typically more than the company’s current stock price. As we saw in Southwest’s case, the conversion price was $38.48 compared to the stock price at that time of $28). At the date of redemption, there are two possibilities:

- The share price rises: The fair value of the convertible bond will also increase as it has a direct relationship with the movements of the share price.

- The share price decreases: The investor will still get the agreed upon conversion value. This par value of the bond, which will prevent the holder from Equity-risk, is known as “Bond Floor”.

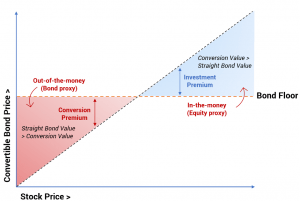

The conversion ratio of such instruments is generally set at a price which is at a premium of around 30-40% of the existing share price. Thus the option is “out of the money” (see the red area in the chart above) until the share price goes above the bond floor price (PV of coupon payments and par value of the instrument).

Now that we’ve discussed convertible bonds at length, let us find out how they’re presented and accounted for as per IFRS 9, with a simple example:

Let’s assume Sunshine Ltd. issued 1,000 nos. convertible bonds maturing in 5 years, with a face value of INR 1,000 each. They carry a coupon rate of 4% per annum, payable annually at the end of the year.

At the option of the holder, the bonds can be converted into equity shares instead of cash redemption at the end of 5 years.

The total proceeds received are thus INR 10,00,000. Market rate of interest for bonds without a conversion option is 6%.

Classification as per IFRS 9: It is a compound financial instrument as it contains the below 2 elements:

- Liability component = Sunshine’s obligation to pay fixed coupon & redemption value in cash (if the holder chooses that option)

- Equity component = Bond holder’s option to get the bonds converted into shares after 5 years (instead of a fixed cash amount)

Now that we have understood the concept, let us see how to account for this compound financial instrument:

Step 1 – Determine fair value of the liability component. Make a simple table of Discounted Cash Flows.

Year | Coupon (4% x 10,00,000) | Principal Repayment | Total Cash Flow | Discounting Factor (at 6%) | Present Value |

1 | 40,000 | 40,000 | 0.9434 | 37,736 | |

2 | 40,000 | 40,000 | 0.8900 | 35,600 | |

3 | 40,000 | 40,000 | 0.8396 | 33,585 | |

4 | 40,000 | 40,000 | 0.7921 | 31,684 | |

5 | 40,000 | 10,00,000 | 10,40,000 | 0.7473 | 7,77,148 |

Total | 9,15,753 |

Thus, present value of the liability component is INR 9,15,753.

Step 2 – Assign remaining residual value to the equity component.

The residual amount of INR 84,247 (10,00,000 – 9,15,753) is thus, the equity component.

Step 3 – Accounting Entry for Initial Recognition

Particulars | Debit | Credit |

Cash | 10,00,000 | |

To Convertible Bond | 9,15,753 | |

To Equity (Convertible Bond) | 84,247 |

After initial recognition, the equity component will not be re-measured. The liability component will be accounted for at effective interest rate method as per IFRS 9.

Put on Your Thinking Cap!

- Are you aware of any start-up that has recently raised capital through hybrid instruments? (let me know in the comments below!)

- Did you know that until recently even Tesla Motors used to be a big issuer of convertible debt instruments?

If you have any doubts or if you’d like to discuss IFRS 9, feel free to drop me a line on my LinkedIn profile! Lastly, if you think this article would prove useful to someone, do share it with them.

Sources: The Economist, Bloomberg, Blue Ocean Strategy by Harvard Business Review Press, Investopedia.com, Calamos Investments.

Hi there! This post couldn't have been written any better! Reading this post reminded me of my previous roommate! He always kept talking about this. I will forward this article to him. Pretty sure he will have a good read. Thank you for sharing!