When we asked a group of 100 business owners (particularly from the manufacturing & trading industry), what are the major challenges they face in their business, 6 key problems stood out in particular:

- Debtors not paying on time

- Slow moving stocks in the Inventory

- Unable to pay creditors on time

- Low productivity of employees

- Fluctuating Revenue and Profits

- Profits in the books but no cash in the bank (where is the cash?)

Not addressing the above issues in the right way will ultimately lead to closing down of the business and no entrepreneur would want that.

Often Business owners of the Small and Medium Enterprises (SMEs) focus on increasing the sales of the business and pay little to no attention on the finances of the company. Which is why even with increasing sales, these businesses suffer with liquidity issues.

Why doesn’t every business in India grow to become a Reliance, Tata or a Mahindra?

To understand the above question, let’s dig into the story of a company which started off as an SME and is today one of the biggest retailers in India.

In 2002, DMart was launched in an era where people widely preferred to go to their nearest kirana store for buying their everyday essentials. Yet today, Dmart has opened over 238 stores across the nation without shutting down a single store.

What made it a success?

DMart decided to follow certain strategies with respect to its debtors, creditors & inventory to ensure that it has an efficient working capital cycle.

Being in the retail business, DMart had no wait time to recover money from customers. Which, it used to its advantage by paying its vendors in less than 15 days. This in turn helped them secure discounts from the suppliers.

DMart passed on the benefit of these discounts from vendors to its customers by giving “Everyday Discounts” rather than seasonal offers. This helped them increase their sales exponentially and get into a positive working capital cycle.

(For more insights, read my blog on “The Business Strategies that made DMart a success”)

However, it is important to understand that it is not a ‘one size fits all’ approach. What worked for DMart may not necessarily work for your business.

Usually, entrepreneurs resort to the same solutions the moment they come across a crisis – bank lending or a halt in operations. However, effective solutions which are specific to each business exist and these are often more rewarding with less of a risk!

How important it is to have an ‘Objective Outsider’ in your business?

Krishna never took up weapons in the war of Mahabharata, but it was his suggestions and advice that helped the Pandavas win the war and create a legacy empire. This proves why having an expert help who has an overall understanding of your business and can take decisions objectively can help you create a legacy business.

The reason why most SMEs don’t grow into corporate giants is because they don’t have a good review system which helps them identify the bottlenecks in their business and eventually eliminate them.

A good Review System shows where the firm is going wrong and what it can do to correct it.

Here is where we come into play.

ConTeTra provides you with a Review Mechanism that will help you see where your money actually goes. We call it the Profit Cash Valuation Simulator (PCV).

PCV is a data driven tool which enables us to help you continually track key financial performance indicators.

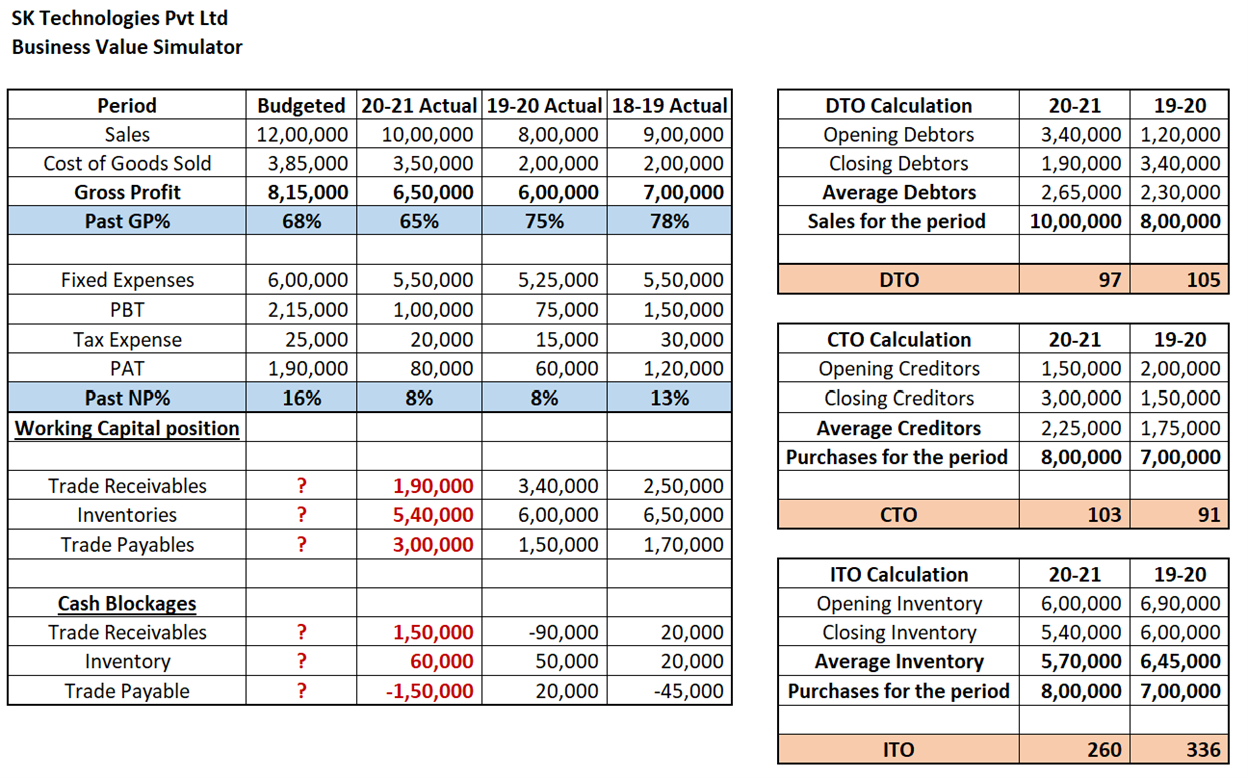

A glimpse of our PCV Simulator:

In this glimpse of our PCV Simulator above, you can see that we evaluate the cash position of your business by tracking the 3 below key indicators:

- DTO (Debtors Turnover) – The number of days it takes for your debtors to pay you back on an average.

- CTO (Creditors Turnover) – The number of days it takes for you to pay your creditors back

- ITO (Inventory Turnover) – The number of times you have replaced your inventory in a year.

With the above 3 indicators, we help you identify your working capital position and the areas of cash blockages in your business. PCV also predicts the working capital position for the next year based on budgeted figures and helps you to ascertain where your cash will be blocked in the upcoming year.

Find out how our PCV Simulator helped businesses across India solve their liquidity as well as operational problems:

#Challenge 1:

Debtors not paying on time – A 55-year old industrial battery manufacturer who serviced every major power company constantly struggled with liquidity issues and resorted to bank funding often.

Our solution – Identified the major issue as Debtor Collection, helped reduce the Debtor Collection period from 75 days to 45 days by modifying the working capital policy of the company!

#Challenge 2:

Unable to pay creditors on time – A leading manufacturer of printers, despite of hitting a turnover of 7 crores was unable to improve sales.

Our Solution – Identified delayed deliveries as a problem which was due to delays in procurement. Reduced the payment cycle to vendors from 100 day to 50 days resulting in timely deliveries and discounts.

#Challenge 3:

Slow moving stocks in the Inventory – A distinguished tractor manufacturing unit, struggled with slow moving stocks.

Our Solution – Identified and eliminated the bottleneck in operations by studying and analyzing the whole manufacturing process.

#Challenge 4:

Low Productivity of Employees – The above mentioned battery manufacturing company also struggled with low productivity of employees due to ambiguity in their roles.

Our Solution – Provided with a detailed organization structure and defined their employee policies resulting in improved morale and strengthening the loyalty of the employees towards the organization

#Challenge 5:

Fluctuating Revenue and Profits – A leading tissue culture company in the business of selling banana and Papaya sapling, despite seeing unit level profits was unable to understand the reasons behind their losses.

Our Solution – With our “Lead to Sales Conversion” Tracker, we were able to analyses data of each unit and monitor critical business parameters thereby improving the sales and profits by a whopping 30%!

#Challenge 6:

Profit in the books but no cash in your bank – All the above solutions lead to a positive working capital efficiency which ultimately result in generating cash for your business.

Do you want to find out where your Cash is stuck and what are the bottlenecks in your business?

Set up a non-chargeable call with our team of strategic consultants who will give you effective solutions with the help of our PCV Simulator!

Feel free to book a slot here for a personal one-to-one review: https://calendly.com/biz-owners/30min?month=2022-06

Or drop me a mail at: manila.sanghani@contetra.com

iHerb promo code 5-80 % off >> https://code-herb.com/

Dear contetra.com owner, Your posts are always well presented.

To the contetra.com owner, You always provide practical solutions and recommendations.

To the contetra.com administrator, Thanks for the well-structured and well-presented post!

To the contetra.com webmaster, Your posts are always well-balanced and objective.

Hi contetra.com admin, Your posts are always well presented.

Dear contetra.com admin, Your posts are always well-received and appreciated.

Hello contetra.com administrator, Your posts are always well written.

Hi contetra.com owner, Your posts are always well researched and well written.

Dear contetra.com admin, Your posts are always well presented.

To the contetra.com admin, You always provide practical solutions and recommendations.

Dear contetra.com administrator, Your posts are always well received by the community.

To the contetra.com administrator, Your posts are always well-cited and reliable.

To the contetra.com owner, Keep it up!

Hi contetra.com owner, Your posts are always well-delivered and engaging.

Hi contetra.com administrator, You always provide great examples and case studies.