In the world of business, the interplay between growth in business and profitability presents a never ending dilemma for business owners.

So the questions arise: Which aspect of growth and profitability should be prioritized? How do you measure growth and profitability? How to grow profitably in the long run?

Well, the answer is not a one-size-fits-all solution; rather, it hinges on various factors, including your business objectives, its current stage, business growth strategies and your tolerance for waiting.

As we move beyond the challenges of the pandemic, a remarkable shift has been observed – a surge of SMEs aiming to access the capital markets through Initial Public Offerings (IPOs) for their expansion and growth in business.

The statistics speak for themselves:

| Year | No.of Companies | Amount Raised (Rs.) |

|---|---|---|

| 2021 | 59 | 746 Crores |

| 2022 | 109 | 1,874 Crores |

The momentum continued in 2023, with 73 SME IPOs raising an impressive Rs 1917 crore till June 23, signalling a significant growth trajectory.

So, how can you effectively achieve profitable growth for your business?

Define the real terms of profitability and growth

The answer is simple. Indian MSMEs have been champions in creating businesses for decades with simple dynamics:

- High profit margin

- Quality products

- Customer Satisfaction

- And eventual growth with retained profits

But over the past decade, the core business values have changed rapidly. Today, a business is not just about revenue and profitability. It is about delivering value and convenience to multiple stakeholders. It’s about delivering a favourable outcome for each stakeholder.

Let’s examine the five crucial stakeholders of a business and compare the results they anticipate from each business strategy: profitability and growth.

| Stakeholders | Profitability | Growth | Profitability + Growth |

|---|---|---|---|

| Business owner | More Profit | Market share with global reach | Global expansion while being profitable. |

| Customers | Low price | Quality, Value | Value for money, Brand value |

| Employees | High Salary | Job security, and career growth | Competitive salaries with opportunities for Career Growth |

| Vendors | Timely payments | Long term partnerships | Steady orders with timely payments |

| Investors | Returns, dividends | Capture the market’s potential | Sustainable growth with high ROI |

In the simplest terms, profit is the essential key to survival for any business, but growth is the key to the long term success of your business.

Assess and understand the real definition of profitability and growth for each stakeholder in your business.

Devise a sustainable growth plan

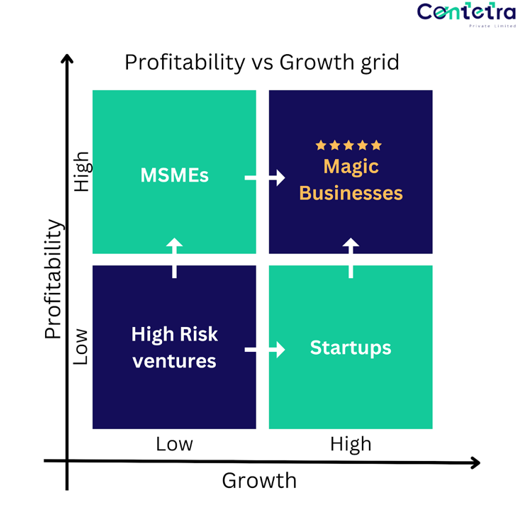

To assist you in navigating this critical decision, we’ve compiled a comprehensive growth vs profitability matrix guide.

Here, we shed light on each quadrant, providing valuable insights to help you make an informed choice that aligns with your business goals.

Quadrant 1: Low Growth, Low Profitability – Companies facing challenges to achieve both growth and profitability, requiring strategic transformation and optimization.

Quadrant 2: High Growth, Low Profitability – Companies prioritizing growth over short-term profits, needing to find a clear path to profitability while maintaining growth momentum.

Quadrant 3: Low Growth, High Profitability – Companies prioritizing profitability over aggressive growth, focusing on operational efficiency and delivering value to customers.

Quadrant 4: High Growth, High Profitability – Companies experiencing rapid growth and healthy profitability, striking a balance and leveraging growth to fuel profitability.

So, which quadrant are you in and where do you aim to be?

Understanding the dynamics of each quadrant empowers you to strategize effectively based on your unique circumstances. As you contemplate your business growth strategies and profitability, keep these considerations in mind:

- Objectives:

Define your short-term and long-term goals to shape your approach. Are you aiming for rapid growth in business or sustainable profitability?

- Business Stage:

Assess where your business stands in its lifecycle. Early-stage start-ups might prioritize growth to gain market share, while established companies may emphasize profitability.

- Patience and Investment:

Consider how long you are willing to wait for returns. High-growth strategies may take time to translate into profits, while profitability-focused approaches yield more immediate results.

- Market and Industry:

Analyse the competitive landscape and growth potential in your market. Different industries demand varying growth and profitability strategies.

Use the rule of 45

In the world of finance, seasoned Wall Street bankers often share insightful rules of thumb to assess a company’s potential for exceptional market valuation.

One such rule, known as the “Rule of 45,” combines annual growth rate and operating margin as key indicators of a company’s success.

The Rule of 45 stipulates that for a company to achieve a remarkable valuation in the market, the sum of its annual growth rate and operating margin must surpass 45 percent. While this rule is not an absolute formula, it serves as a valuable framework for balancing growth and profitability considerations.

On one end of the spectrum, rapid growth above 45 percent allows a company to tolerate breaking even or even operating at a loss, as the market rewards the potential for substantial expansion. However, achieving such a high growth rate can be demanding and requires careful resource allocation and strategic planning.

Conversely, for companies experiencing slower or stagnant growth, the Rule of 45 emphasizes the need for an operating margin exceeding 45 percent to attain a high valuation. Yet, maintaining such high operating margins over time can be exceptionally challenging and necessitate operational efficiency and cost management.

This principle highlights the crucial notion that companies cannot afford prolonged periods of stagnation without risking their value and relevance in the market. As businesses aim to benchmark themselves against industry leaders, they can use the Rule of 45 as a straightforward tool to assess their growth objectives and consider their impact on operating margins.

To strike the right balance between profitability and growth in business, businesses must adopt a more scientific and data-driven approach rather than relying solely on gut feelings. Making informed decisions requires a thorough understanding of the company’s performance, and this can be achieved by closely monitoring KPIs and essential metrics that align with their long-term goals.

We hope you found this to be an insightful read!

Want to know what are some of the important metrics you should track?

Stay tuned for our next blog to know more!

At Contetra, we have worked with 125+ business owners to – release blocked cash, prepare their business plan, set budgets, remove bottlenecks, and implement other strategies to take their business to new heights!

Set up a FREE exclusive call with our team of strategic consultants who will give you effective solutions!

Feel free to book a slot here for a personal one-to-one review with one of our business consultants: https://calendly.com/reachout-_g/30min?month=2023-06