Hello Business Owner!

Have you found yourself wondering –Do I need to perform a business financial analysis? What is my strategy for growth? How can I optimise my sales strategy to increase my revenue?

After all, as a business owner, you know it’s all about the numbers!

When answering this question, there are multiple things that come into play – your product pricing, your marketing strategies, targeting & segmentation, etc. The most important thing to keep in mind is – to have a plan in place and go step-by-step. Most business owners make the most common mistake of rushing in to execute strategies without a proper plan in place.

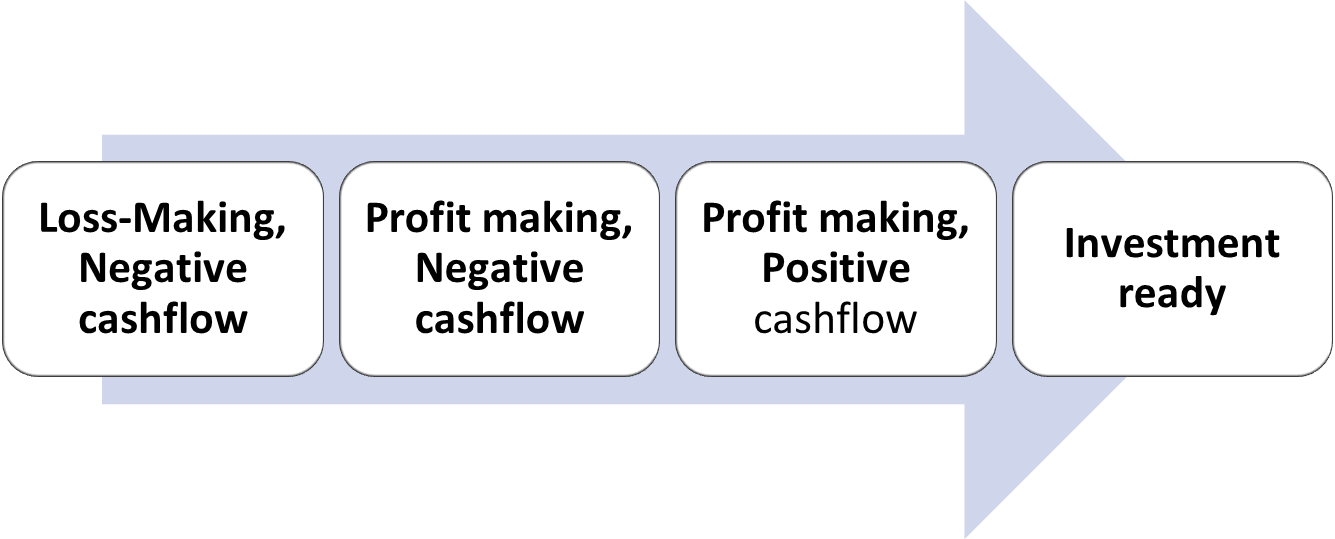

To make this plan, you first need to know which stage your business is currently in.

So, what are these stages and what do they tell you?

Stage 1: Loss-Making, Negative Cashflow

Businesses in this category are currently making losses and seeing negative cashflow. They need to conduct a comprehensive financial analysis to pinpoint the causes of losses. Analyse your income statement, balance sheet, and cashflow statement to identify areas where expenses are exceeding revenue.

Addressing negative cashflow is vital for survival. Explore financing options like loans, lines of credit, or seeking equity investment. Cut non-essential expenses and prioritize essential ones.

In this stage, the primary focus of the business should be on achieving profitability and positive cashflow. Avoid aggressive expansion plans until you stabilize your financials. Your growth strategy should be about cost control, pricing optimization, and efficient operations.

How can businesses in this stage improve their financial health and move to the next stage?

- Cost Control:

Identify areas of excessive spending and implement cost-cutting measures. This may involve renegotiating contracts with suppliers, reducing unnecessary overhead, or optimizing production processes.

- Pricing Strategy:

Reevaluate your pricing strategy. Ensure your prices cover costs and allow for a reasonable profit margin. Consider value-added services or premium offerings that can justify higher prices.

- Revenue Generation:

Focus on increasing sales and revenue. This could involve expanding your customer base, launching new products or services, or entering new markets.

- Negative Cashflow Management:

Improve cashflow by collecting receivables faster, extending payables strategically, and reducing inventory holding costs.

Stage 2: Profit-Making, Negative Cashflow

When asked what is more important for any business – Cash or Profit, most people get it wrong.

Profits do not ensure the survival of your business, but cash does.

Businesses in this bucket should analyse their cashflow statement to understand why they have negative cashflow despite profitability. Often, this is due to slow-paying customers, high inventory levels, or aggressive growth strategies that consume cash.

Businesses in this stage should prioritize positive cashflows. Improve working capital management by reducing accounts receivable days, managing inventory levels efficiently, and negotiating better terms with suppliers. Reinvest profits but do so cautiously to balance growth with liquidity.

How can businesses in this stage improve their financial health and move to the next stage?

- Working Capital Management:

Continue to optimize working capital. Implement more efficient inventory management, tighten credit policies for customers, and negotiate favourable terms with your suppliers.

- Reinvestment:

Gradually increase reinvestment in the business to fund growth initiatives. Consider investments that will improve operational efficiency, expand product lines, or enhance customer service.

- Debt Reduction:

If you have debt, prioritize paying it down to strengthen your balance sheet and reduce interest expenses.

- Operational Efficiency:

Look for opportunities to streamline operations and reduce unnecessary expenses. Investing in technology or automation can often improve efficiency.

Stage 3: Profit-Making, Positive Cashflow

With profitability and positive cashflow, you have financial stability. Now your focus should be on maintaining this stability and maximizing it.

In this stage, you have the flexibility to consider various growth options. You can pay down any outstanding debt to strengthen your balance sheet, and reinvest in the business to fund organic growth. Explore opportunities that align with your long-term vision, like expanding into complementary product lines or entering new geographical markets.

How can businesses in this stage improve their financial health and move to the next stage?

- Strategic Planning:

Develop a comprehensive growth plan that outlines specific objectives, strategies, and resource requirements for scaling the business.

- Market Expansion:

Identify new markets or customer segments with growth potential. Consider geographic expansion or diversification of product and service offerings.

- Capital Raising:

Seek external financing from investors, venture capital firms, or banks to secure the capital needed for rapid growth. Prepare a compelling business case and financial projections to attract investors.

- Operational Scalability:

Ensure that your operations can scale efficiently to meet increased demand. Invest in infrastructure, technology, and talent to support growth.

- Marketing and Sales:

Expand marketing efforts to reach a broader audience. Invest in sales and marketing teams to capture market share.

- Risk Management:

As you grow, pay attention to risk management, including compliance, cybersecurity, and supply chain resilience.

Stage 4: Investment Ready

Businesses here are in an excellent position to attract investors due to their profitability and positive cashflow. However, they need substantial capital for rapid expansion.

Develop a compelling growth plan that outlines how you intend to use the investment capital to scale operations and capture a larger market share. Allocate resources to marketing, research new markets, expand your product or service offerings, and invest in talent acquisition. Be prepared to prioritize market share and revenue growth over short-term profitability.

Seeking advice from a financial professional can also be helpful for businesses in this bucket. A financial advisor can help with managing the investments and tracking the ROI from these investments. These advisors will help implement robust performance metrics and key performance indicators (KPIs) to monitor the progress of your growth strategies. They will also regularly assess your performance against these metrics and adjust your plans accordingly.

If you want to know more about how one of our clients progressed from bucket 1 to bucket 3, and how we were an instrumental part of this journey, stay tuned for our next blog!

If you would like to know how we can help you move from one stage to the next, set up a non-chargeable business review call with our team of strategic consultants here -https://calendly.com/reachout-_g/30min?month=2023-09

Let us help you take your business to the pinnacle of success!