Do you know there are about 40 crores of registered SMEs around the world? These SMEs account for over 95% of firms and 60%-70% of total employment globally. And these are just the official numbers. Think of the non-registered entities and solopreneurs.

And with the advent of the Industrial Revolution 4.0, these numbers are growing exponentially. But here the question arises – How does an SME trade and comply with foreign policies?

Imagine you’re a small or medium-sized enterprise (SME) with foreign subsidiaries and big global ambitions. You’ve been crunching numbers and managing accounts each for a different geography. However, there is no unified process and standards for SMEs and implementing IFRS is a bit tedious.

To solve this problem IASB launched IFRS for SMEs for businesses like yours.

In this blog, we’ll break down everything about IFRS for SMEs key differences compared to the full IFRS (International Financial Reporting Standards).

What is IFRS for SMEs?

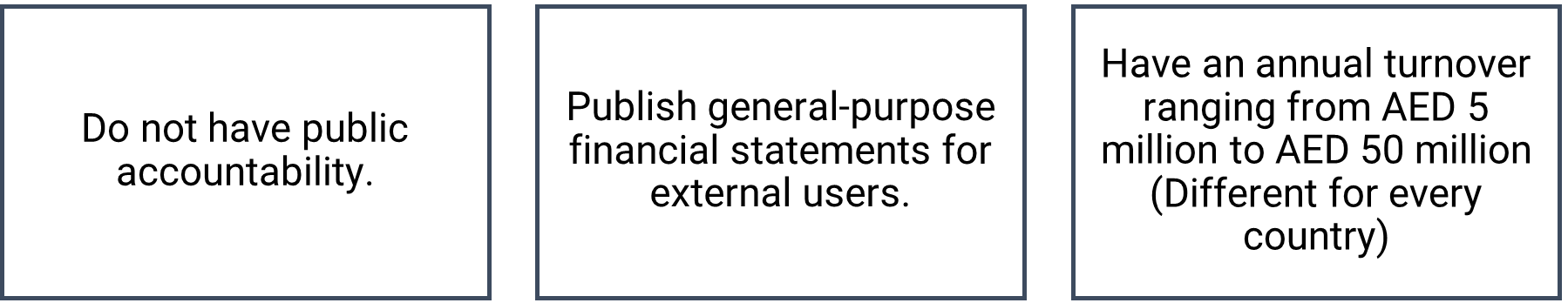

IFRS for SMEs stands for International Financial Reporting Standards for Small and Medium-sized Enterprises. It’s a tailored accounting framework designed specifically for smaller businesses. These are entities that:

But, what does public accountability mean?

Public accountability, in this context, means that an entity:

- Has any debt or securities listed or in the process of listing, OR

- Holds assets in a fiduciary capacity for a broad group of outsiders as one of its primary businesses.

Purpose of the Standard

IFRS for SMEs was introduced with several goals in mind:

- Simplify Reporting: One of the primary objectives is to streamline accounting standards for smaller businesses. This simplification reduces the complexity and cost of financial reporting.

- Global Consistency: The standard aims to promote uniformity in financial reporting across countries. This makes it easier for stakeholders, including investors and creditors, to assess the financial health of SMEs, even if they operate in different parts of the world.

- Access to Capital: IFRS for SMEs improves the credibility of financial reporting for smaller businesses. This, in turn, facilitates access to international capital sources and attracts global investors.

- Cost Savings: By aligning with IFRS for SMEs, SMEs can significantly reduce compliance costs related to financial reporting and auditing, allowing them to allocate resources more efficiently.

- Informed Decision-Making: Providing high-quality financial information is crucial for the management of SMEs. IFRS for SMEs ensures that these businesses have the data they need for informed decision-making.

Pros and Cons of Adopting IFRS for SMEs

SR. NO | PROS | CONS |

1. | Global Comparability: IFRS for SMEs allows for easier comparison with international peers. This comparability can attract investors and facilitate global business transactions. | Implementation Costs: Transitioning to IFRS for SMEs may require initial investments in training and systems to ensure compliance. |

2. | Simplified Reporting: The standard simplifies financial reporting for SMEs, reducing the compliance burden and associated costs. | Loss of Specificity: Some SMEs may find that certain industry-specific accounting standards they were using previously are no longer available under IFRS for SMEs. |

3. | Potential Tax Benefits: Adopting IFRS for SMEs can lead to reduced reporting costs, more effective tax planning strategies, and accounting for future tax benefits. This may result in lower tax liabilities in the short term. | Lack of Accounting Expertise: While simpler than full IFRS, IFRS for SMEs may still be complex for very small businesses with limited accounting expertise |

IFRS for SMEs: First-Time Adoption

When a company decides to adopt IFRS for SMEs for the first time, they need to consider the following:

Retrospective Application

- Companies can choose to apply the standard retrospectively, which means they restate prior periods in accordance with IFRS for SMEs.

Optional Exemptions

Companies can choose to take certain optional exemptions, including:

- General Exemption: Entities may choose not to restate their previous accounting for business combinations, share-based payment transactions, fair value or revaluation as deemed cost, cumulative translation differences, designation of previously recognised financial instruments, financial assets or financial liabilities at fair value through profit or loss, decommissioning liabilities included in the cost of property, plant, and equipment, leases, service concession arrangements, and borrowing costs.

Mandatory Exemptions

- There are also mandatory exemptions from retrospective application for the derecognition of financial assets and financial liabilities, hedge accounting, cumulative translation differences, fair value or revaluation as deemed cost, and comparative information.

Difference Between Full IFRS and IFRS for SMEs

One of the most important things to understand while implementing IFRS for SMEs is the difference in this standard vs full IFRS. This helps you understand the various advantages associated with implementing IFRS for SMEs and how it can be beneficial for your business.

The key difference between full IFRS and IFRS for SMEs lies in the complexity and depth of the accounting standards. Full IFRS is designed for larger, more complex businesses, while IFRS for SMEs is tailored to the specific needs and capabilities of smaller entities. Here are some primary distinctions:

Aspect | Full IFRS | IFRS for SMEs |

Financial Instruments | More detailed and complex standards, including fair value measurement for a wide range of financial instruments. | Simplified and less extensive guidance, primarily based on historical cost. Limited fair value measurements. |

Goodwill | Goodwill is subject to annual impairment testing, and a two-step impairment test is often required. | Goodwill is not amortised but tested for impairment whenever there is an indication of impairment. |

Research & Development Costs | Research costs are expensed when incurred, while development costs are capitalised if specific criteria are met. | Research costs are expensed when incurred, and development costs are capitalised only when specific criteria are met. |

Borrowing Costs | Specific guidance on capitalisation of borrowing costs when qualifying assets are under construction. | No specific guidance on capitalisation of borrowing costs; they are generally expensed as incurred. |

IFRS for SMEs serves as a valuable tool for smaller businesses looking to streamline their financial reporting, enhance global comparability, and reduce reporting costs.

To understand the difference between IFRS for SMEs and full IFRS in depth and the bottom-line implications of the IFRS for SMEs, stay tuned for our next blog!

- Is implementing IFRS for SMEs seeming like a nightmare?

- Need a partner to implement IFRS for SMEs in its true spirit?

- Are you not able to understand the implications on your profits and the business’s valuation?

Look no further!

We, at Contetra, work with CFOs and senior finance leaders to help them simplify their financial reporting and prepare financial statements that make more sense for a global world.

Chat with our team of Chartered Accountants to know more about how we can reduce your burden of financial reporting! – https://calendly.com/contetrapvtlimited/30min