Your inventory is the Pulse of your Organization, informing you about your business’s heartbeat & its health. Just as a slow pulse can signal health issues, a sluggish inventory turnover can indicate deeper financial problems within a company.

A slow inventory turnover can hinder your company’s Cash Flow Optimization, leading to a buildup of costs and inefficiencies. On the other hand, a rapid, well-regulated inventory flow can be the pulse that keeps your business vibrant and competitive. Let’s dive into the What, Why, and Hows of Inventory turnover.

Inventory Turnover: Key to an Efficient Business

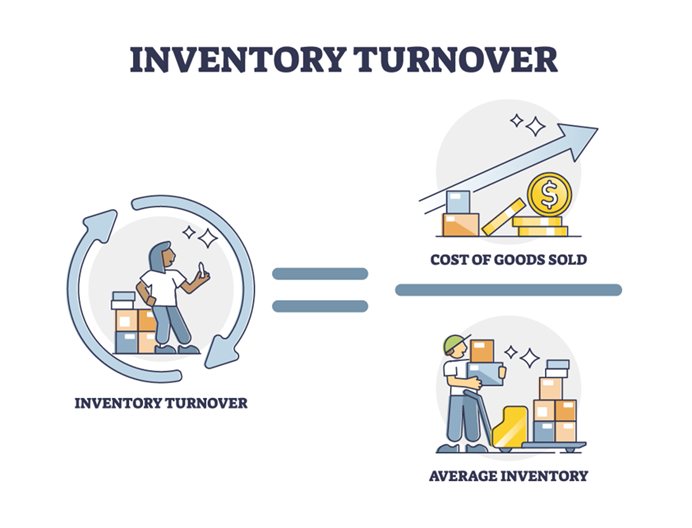

Inventory turnover refers to the number of times a company’s inventory is sold and replaced over a specific period, typically over a year and the Inventory Turnover ratio is an important metric that helps to quantify this, it reflects how efficiently a company manages its inventory.

An optimized inventory turnover ratio holds the key to the financial health and efficiency of your business operations. Proper Cash Flow Optimization ensures that your stock moves up and down your supply chain quickly, giving you cash and fewer overheads. A better inventory turnover ensures leanness in operations while responding to market demands so that you don’t miss out on those sales.

Understanding Inventory Turnover Ratio

- Cost of Goods Sold (COGS): This is the total cost of producing or purchasing the goods that your company sold during a specific period.

- Average Inventory: This is the average value of your inventory over the same period, calculated as the sum of the beginning and ending inventory divided by two.

For instance, Sandy and Co., has ₹1,00,000 as their average inventory and their COGS is ₹5,00,000. Their inventory turnover ratio would be:

Inventory Turnover Ratio = 500,000/100,000 = 5

This means that Sandy and Co.’s inventory turns over five times in a year.

What Is a Good Inventory Turnover Ratio?

A “good” inventory turnover ratio can vary depending on the industry. However, a ratio between 5 and 10 is generally considered ‘healthy’ for most industries. This range suggests that your inventory is moving steadily without excessive stockpiling or frequent stockouts.

- High Inventory Turnover: While a high inventory turnover ratio might seem positive suggesting that you are consistently selling all your goods with great demand, an overly high ratio shows signs of improper strategic financial management. It could signal that you’re not keeping enough inventory on hand, potentially missing out on sales opportunities due to stockouts.

- Low Inventory Turnover: A low ratio may indicate that your products are sitting on shelves for too long, leading to increased holding costs and the risk of obsolescence.

Reasons to Optimize Your Inventory Turnover Ratio

Reduce Holding Costs:

Carrying inventory comes at a cost—warehouse rent, insurance, and depreciation, to name a few. By increasing your inventory turnover, you minimize the amount of stock held at any time, thereby reducing these holding costs. A quicker inventory turnover will help to reduce these holding costs and assist in strategic financial management, particularly beneficial for a business where cash flow might be more restricted.

- Mitigating the Risk of Obsolescence:

In industries where products have a short shelf life like perishable goods or industries which are subject to rapid technological changes, holding onto inventory for too long can lead to obsolescence. A quicker inventory turnover helps ensure that you sell products while they’re still in demand, protecting your business from losses due to outdated stock. - Competitive Advantage:

An optimized inventory turnover ratio can provide a huge competitive edge. With better inventory management, you can avoid stockouts/overstock situations, adapt to the changing market trends ensuring that you always have the right products available for your customers & in return, you never miss out on the potential sales, a clear Win-Win situation. This degree of responsiveness can enhance customer satisfaction and loyalty, setting you apart from competitors. - Cash Flow Optimization:

Efficient inventory turnover directly impacts your cash flow. By selling products more quickly, you convert inventory into cash faster, which can then be reinvested into other areas of your business. An optimized inventory turnover can help reduce the Cash Conversion Cycle (CCC), enhancing financial flexibility and freeing up cash for growth opportunities or saving it to navigate during uncertain times.

Ways to Optimize Your Inventory Turnover

Demand Forecasting:

Accurate demand forecasting helps you predict future sales, allowing you to maintain optimal inventory levels. By analyzing historical data, market trends, and seasonal patterns, you can ensure that you stock the right amount of inventory to meet customer demand without overstocking.

- ABC Analysis:

ABC analysis categorizes your inventory into three categories—A (high-value), B (moderate-value), and C (low-value). Analyzing the Turnover ratio of the High-value items (A category) and adjusting your inventory accordingly while maintaining a minimal inventory of low-value items (C category), resulting in an increased turnover while minimizing holding costs for lower-value items. - SKU Rationalization:

Rationalizing your stock-keeping units (SKUs) involves evaluating your product offerings to identify and eliminate underperforming or redundant items. SKU Rationalization is like appraisal but for your inventory. This streamlines your inventory, reduces carrying costs, and ensures that you’re only stocking products that contribute positively to your business. - Leverage Technology :

Leveraging technology like inventory management software can automate various processes, such as reordering and tracking stock levels. Automation reduces human error, provides real-time data, and helps maintain optimal inventory levels, contributing to a quicker inventory turnover. An Inventory Module in your ERP ought to do that.

How Asian Paints Dominates the Market with their Inventory Management

Asian Paints has mastered inventory turnover and strategic financial management, which has been pivotal in maintaining its market leadership. With an inventory turnover ratio of 3.4, compared to Berger Paints’ 2.58, Asian Paints significantly outpaces its competition.

This allows them to sell off their inventory more quickly, translating into an additional 531 KL of paint sold daily, which comes to around ~INR 14,000 crores in annual revenue. A great inventory management combined with their direct-to-dealer distribution model not only reduces holding costs but also improves their profit margins, enabling the company to become the top competitor in the paint industry with a market capitalization of ₹3,02,258 Cr.

Is your Business Struggling to Keep a Healthy Inventory Turnover Ratio?

At Contetra, our seasoned team of Chartered Accountants and Finance Professionals can help you take your business to the next level!

Contact us today to discover how we can help you transform your operations and help you achieve sustainable growth.