Lack of financial control and no performance measurement resulting in lack of clarity for make decision making. Lack of direction resulting uncertain revenues and pricing pressures.

Identification of key drives of business and building strategies for improving them such that it results in positive impact on bottom line and increase in valuation.

Specific strategies to improve the key drives that resulted in targeting 30% growth in revenue along with improvement in EBITDA by 10%.

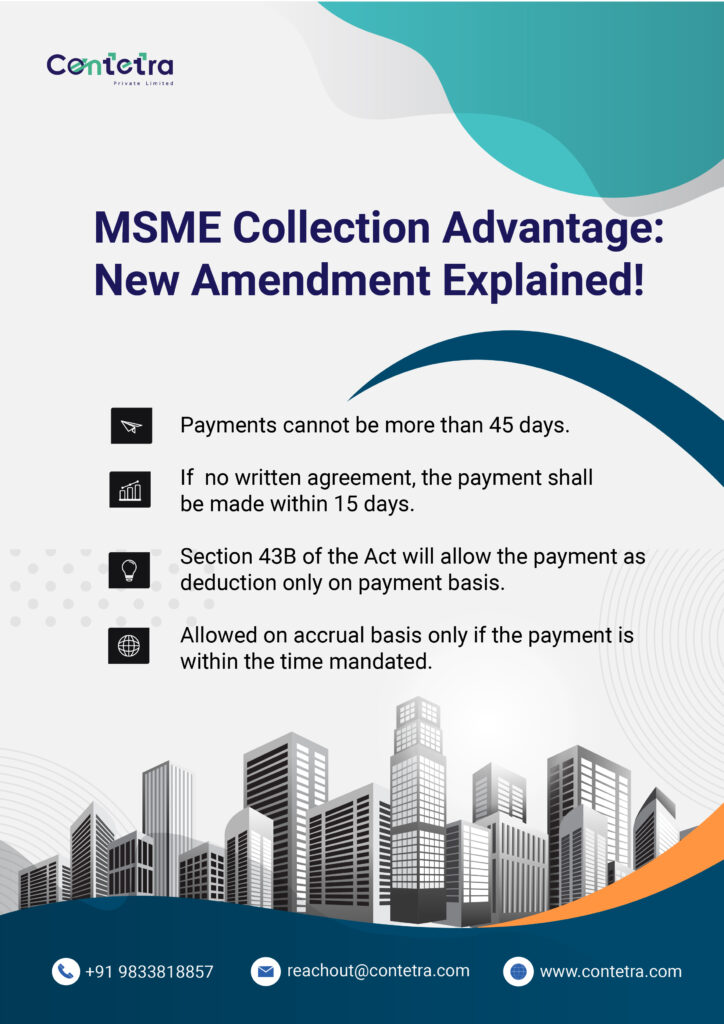

55 years old industrial battery manufacturer (Capital Goods) having serviced every major power and allied companies struggling with constant cash flow challenges and repeatedly resorted to bank funding.

Identified the major challenge being debtor collection. Modified the working capital policy of the company and profiled the customer for improved collection.

Customer payment cycle reduced from 117 days to around 65 days. 2X Revenue growth potential unlocked without significant increase in fixed cost.

27% of inventory identified as completely non-moving inventory. Send only quick moving inventory for interbranch to avoid working capital being blocked in the form of inventory or ITC.

Influx of INR 9 Crores in the working capital by scrapping the identified non-moving inventory. Reduction in inter branch pricing would help branches to utilize ITC balance of approx. INR 60 lakhs over a period of time.

After Flexo printer manufacturer hit a turnover of approx. 7 crores, they were unable to improve sales and profitability on account of lack of financial visibility.

Identified procurement as the bottleneck in operations resulting into a delivery delay. Set the business processes to capture and analysis financial and operational data to control the delivery cycle through vendor consolidation and effective operational policy.

Reduced Cash Conversion Cycle from 100 days to 50 days.

Despite unit level profitability unable to understand the reason for losses. Also, lacked data for control and monitoring.

Identified major challenge being abnormal loss. Designed a plan for regular monitoring of critical business parameters with major focus on controlling abnormal loss.

Sales & Profitability improved by 30%. Potential unexplored revenue of approx. INR 3-5 crores.

Sales stagnant at 12 crores since the last 3 Financial years. Significant delays in data generation resulting in inability to monitor business and take decisions resulting in inability to scale.

Working with existing customers to bring revenue certainty. Identified and removed multiple roadblocks from operations.

Released cash stuck in working capital worth INR 1.5 crores. Identified untapped revenue potential by 2.5X times.

© 2024 Contetra all rights reserved.