is A Service That Helps You Get The Details Of “STRUCK OFF” Companies,

for Hassle-free Compliance With The New Mandatory

Disclosure Requirement Of Schedule III.

Name of the

Struck-Off company.

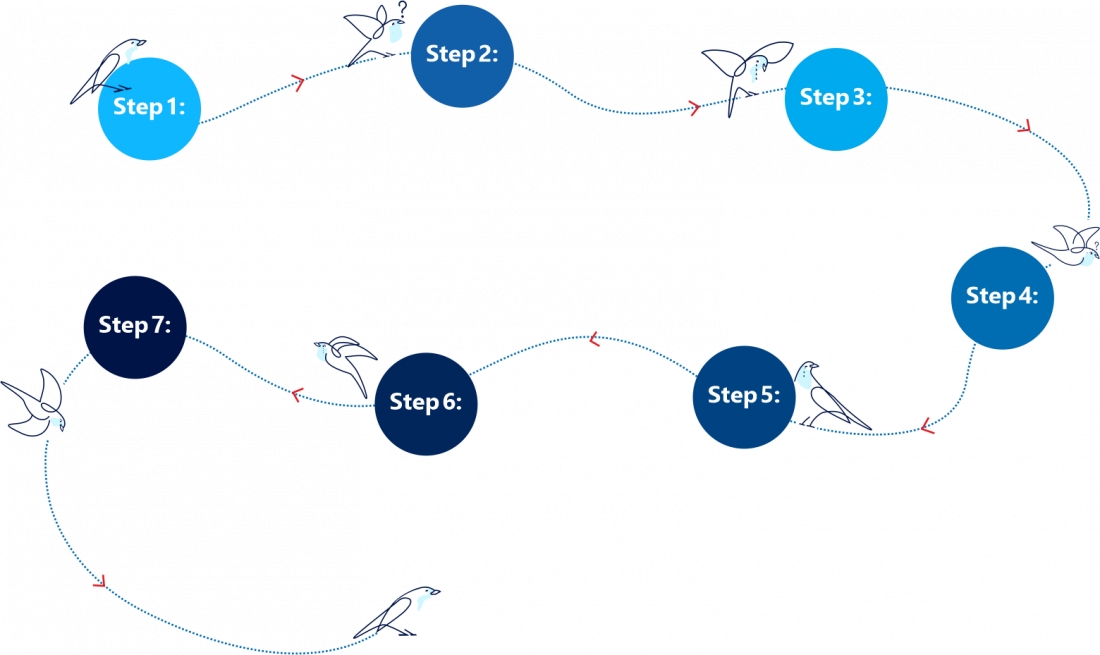

How would you manually do this?

(By spending hours and hours of precious finance team bandwidth)

Get the CIN numbers (There are two ways of

doing this – and both are extremely long-winded)

Step 1:

Step 2:

Step 3:

Step 4:

Step 5:

Step 6:

Step 7:

We have a much easier way out with

You’re free to allocate your resources to more productive activities.

We’ll give you a detailed & accurate report of struck-off status within just 5 working days!

So get

now!

CONNECT WITH US NOW to know more.

Pricing Plans

*Exclusive of GST

*Exclusive of GST

*Exclusive of GST

*Exclusive of GST

FAQ

A Struck off company means the company is no longer operational and it is removed from the list of registered companies.

We simply require the company name and PAN/GST number to figure out the struck off status of a company.

When the company strikes off, the business gets removed from the registry. This means that the company can no longer operate. Hence, the struck-off company’s assets get transferred to the government. Later, the government uses these assets to pay the debts.

The complete procedure takes 3-4 months or more, as the ROC verifies all the documents. This is done as soon as an application is made to the registrar of companies through files, eforms, MGT-14 and STK-2 with penalty charges.

It is mandatory to file INC-20A and AOC-4, as well as MGT-7/7A, before applying to ROC for strike-off. As mentioned earlier, the struck-off company’s assets get transferred to the government, and it may be fined one lakh rupees.

Yes, we can activate the strike off company.

A struck off company can be recovered by administrative restoration. If a firm that has been struck off for a period of time that does not exceed a year may apply under this method by completing the Administrative Restoration form and sending it to Companies House.

Court Order Restoration may be used to complete the restoration if the 12-month time has already passed.

According to the Company Act 2013, the board of directors must pass a resolution striking off the company. The company files STK-2 with the registrar of companies. The registrar publishes a notice in the official gazette and gives a 30-day notice for objections from stakeholders.

We can provide you the output report with struck off status for your list of customers and vendors, by accepting only GST or PAN in the input file. We don’t require CIN number details and instead we provide CIN in the output file.

We can run struck off companies checks in bulk and provide the most accurate status report in the shortest turnaround time.

Only two possible ways to find MCA struck off companies:

1.Do it manually; check every company manually on MCA website for it’s struck-off status.

2.Get it done by a tool like “Strike that” to get the most accurate results in the shortest possible time.

No, as we respect the confidentiality of the data that each of our clients share with us in order to get the correct status of strike off companies.

So, we don’t store any data with us, and nor do we provide access to our tool. The methodology is simple as stated under:

1.You share input file in excel format containing the list with business names, PAN and / or GST details.

2.We process the file at our end, handle exceptions manually, and then rerun the file to ensure tool-based verification.

3.We deliver the most comprehensive output file containing the accurate registered business names, CIN details, and status of each of those companies (amalgamated, active, struck off, etc.).

Yes, you can check the output report sample to understand how you will receive the final file. This sample struck off output report can be seen here – Download Now!

No, our tool is currently not able to check / verify the MSME status of companies. We are building the code behind helping to check the MSME status of companies (vendors or customers) and will soon come up with a positive update on this front!

© 2024 Contetra all rights reserved.