Crores in revenue, profitable on every sale, timely payments, but still no cash in your bank? Sounds familiar?

Well, that is the situation of most SME manufacturers in India. They are definitely the Kings of their industry, but let’s agree that the bottom line is: CASH RULES ALL!

Even if you’re the best in the market, if you don’t have cash in your pocket, someone else with cash to burn will acquire your market share in the coming days. It is the harsh reality, and you know it too!

After all, the market is fair game for everyone.

So, what’s the solution here? How do you improve your cash flow?

It’s easy, follow this simple checklist to ensure improved cash flow in your business.

- Know how your inventory works: The natural tendency of business owners to focus on sales growth rather than net profit leads to them ignoring cash flow monitoring, accounts receivable and inventory. Unchecked inventory freezes money in unsold goods, drains resources with carrying costs, and reduces sales opportunities.

These left unchecked can lead to roadblocks in cash flow management for the business and needless stress and pain for the owner.

Stay tuned; later in the blog, we will discuss how we helped our customer release cash stuck in inventory.

- Receivables and Invoices: Businesses run on just cash, nothing else. Businesses tend to provide additional credit to their customers, ultimately losing the time value of money. Then, it becomes a never-ending cycle where every business has a few debtors who ask for credit for a few more months to pay the bills. So how can you improve your cash flow and avoid delayed payments from your debtors?

There is a simple solution to this: SEND INVOICES WITH A DEADLINE! Post which you charge interest.

- Repair your cash leakages: Ensure cash flow monitoring to pinpoint where you’re losing most of your cash. Try to find alternatives to the same process/source. A simple change in supplier or negotiating credit terms can also save your business cash flow.

Let’s understand how these simple steps can be used in real-life business.

Palak Steels (name changed) is a well-established stainless-steel trader in Gujarat facing stock conversion issues. To understand better, let’s know the basics of Palak Steels.

Revenue: Rs. 100 crores +

Gross Margin: 4-5%

Stock Conversion Cycle (From raw materials to finished goods): 1 day.

Time to deliver raw materials: 4 days.

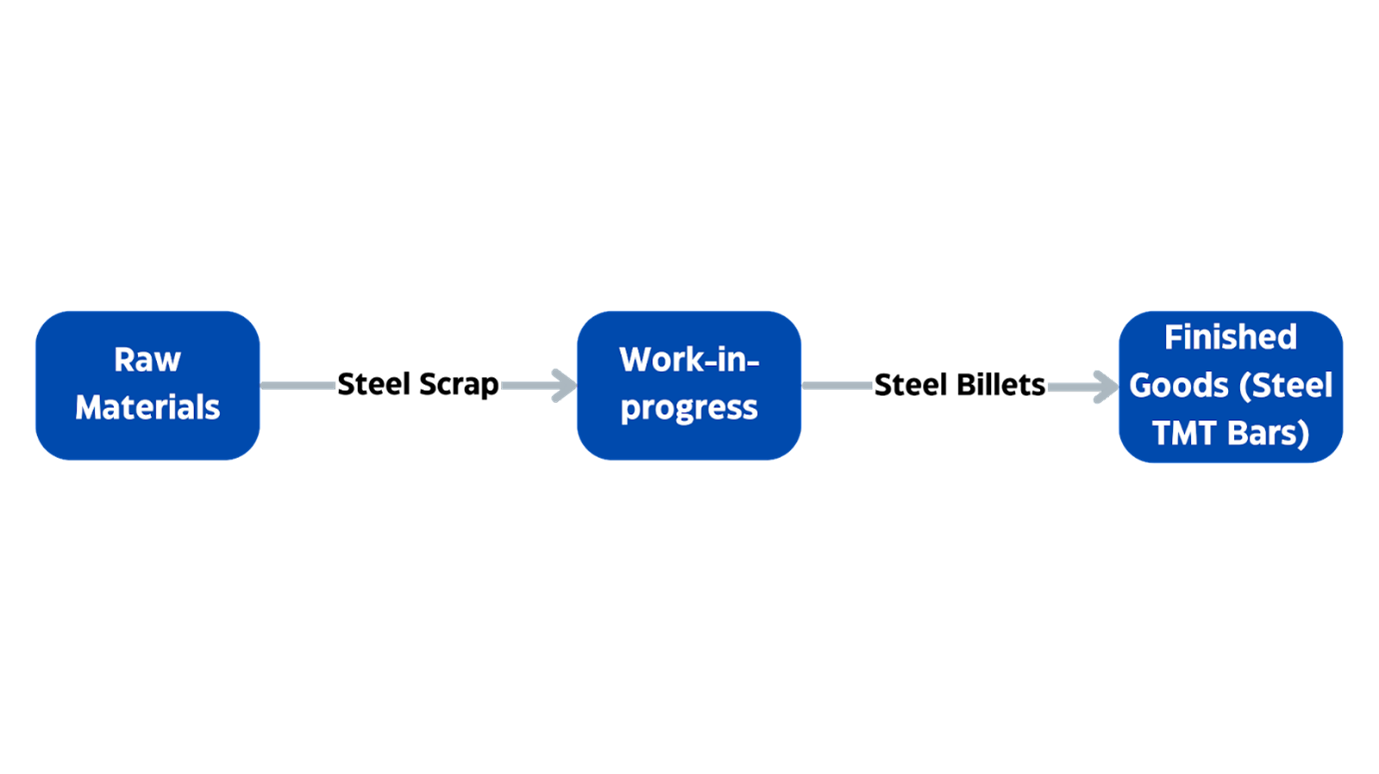

Here, Palak Steels was in a very simple business. The company converted scrap steel into steel billets and then steel billets into TMT steel bars.

One raw material and one finished product. Simple right!?

But before we took over the finances, Palak Steels was unknowingly stocking up the raw materials in advance before the production of steel billets started.

As the raw materials needed 4 days to deliver, Palak Steels had to order and pay (usually financed by OD) in advance. And without any monthly sales projections and cash flow management strategies, the company always used to stock up on raw materials.

Let’s understand how we helped them improve cash flow and released around Rs. 3.5 crore in cash in just a month.

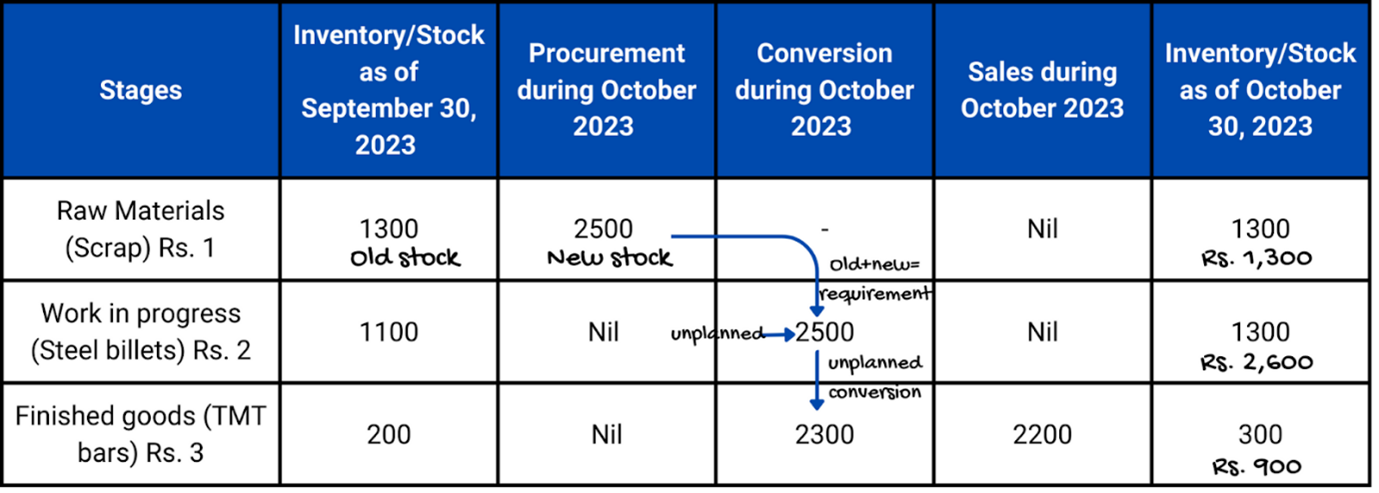

Palak Steels used to work on an ad-hoc basis, as the customer requested, and the company delivered, which is fair. But at the start of every month, Palak Steels had a minimum inventory of 2500 tonnes of scrap, regardless of the sales projection.

Let me explain with the help of an example.

Let’s assume a simple rule that each tonne of raw material converts one tonne of steel billets and then into one tonne of TMT bars.

In September 2023, Palak Steels had a fixed monthly procurement plan of 2500 tonnes of steel scrap.

As we can see in the above table, Palak Steels had stock of Raw Materials – 1300 units as on September 30, 2023. Due to fixed monthly procurement plan, they ordered new stock of 2500 units in October. Even though they had raw materials of 3800 units, their requirement as per the orders was of converting 2500 units only.

Due to unplanned procurement, conversions and lack of cash flow monitoring, Palak Steels still have a combined stock of Rs. 4,800, without any future orders. Here, Palak Steels, being an SME, had to borrow money from bank to sustain this inventory on a daily basis.

But, in October 2023, the company made a sale of Rs. 6,600, of which Rs. 4,800 is still stuck in inventory, charging interest every day.

To create a procurement plan and improve cash flow for them, we came up with three actionables for the company.

- Get a sales projection chart for every month, as per each client’s requirement.

- Create an inventory of finished goods as per the projected sales.

- The backup inventory at the end of the month should not be more than 10% of the projected sales.

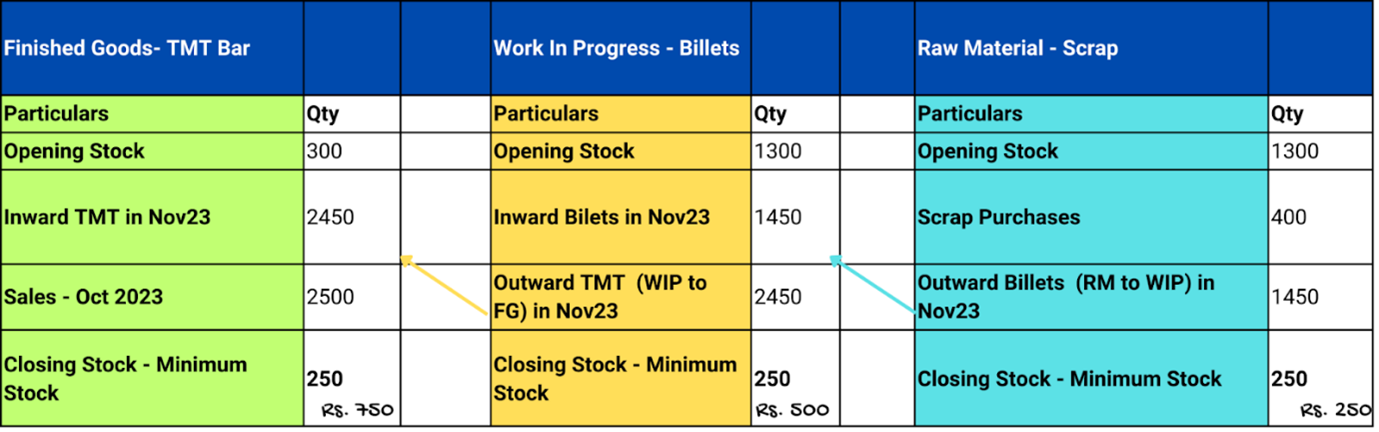

Based on the above actionables given, Palak Steel worked backward to calculate how much raw material they need to order.

So, in the month of November 2023, Palak Steels acts on the three-pointers.

Total Projected Sales= 2,500 tonnes

- Requirement of TMT Bars = (2500-300) + 10% of the projected sales

Requirement of TMT Bars = 2,200 + 250

Requirement of TMT Bars = 2,450 tonnes

They had projected sales worth 2,500 tonnes. Which means they should ideally produce (2,500 tonnes – 300 tonnes in stock) + 10% of projected sales = 2,450 tonnes.

- Requirement of Steel Billets = (2,500-1,300) + 250

Requirement of Steel Billets = 1,450 tonnes

Based on their requirement of TMT bars, they needed Steel Billets 2,500 tonnes (projected sales) – 1,300 tonnes (in stock) + 10% of projected sales = 1,450 tonnes.

- Procurement of Steel Scrap in November = (1,450 – 1,300) + 250

Procurement of Steel Scrap in November = 400 tonnes

Based on their requirement of Steel Billets, they needed Steel Scrap of 1,450 tonnes (requirement of Steel Billets) – 1,300 (in stock) + 10% of projected sales = 250 tonnes.

On November 30, 2023, cash stuck in inventory = Rs. 1,500, which is Rs. 3,800 less than the last month. How did this happen?

Since we helped Palak Steels prepare a procurement plan, they were able to order raw materials only as needed. This helped them improve cash flow and release blocked cash that was stuck in excess inventory.

- Are you facing similar challenges?

- Need help managing your inventory and prepare a procurement plan to be able to improve cash flows?

- Do you now want to find out where your cash is stuck, what are the bottlenecks in your business and ensure cash flow monitoring?

Set up a non-chargeable call with our team of strategic consultants if you want a personalised procurement plan for your business and improve your cash flows – https://calendly.com/reachout-_g/30min?month=2023-06