Running a business is not simple (I can relate with this as a business owner)! But, whether you are running a small business or a Fortune 500 company, one thing that can help you is – checking your finances regularly. You need to have a good idea about the current position of your business.

It’s like having a GPS for your business decisions, and part of that navigation involves understanding your working capital management and cash flow management.

Working capital and cash flow may seem like they’re the same, as they both involve short term cash transactions. But they’re actually two different players in the financial game. Once you get the hang of what each of them does, it’s not as tricky as it might seem. So, let’s start with the basics first!

What is Cash Flow?

The cash flow summarises the company’s cash transactions (account balances, cash, cheques, etc.). It is like the company’s money report card. It tells us how much money is coming in and going out.

If the number is positive, the company is making more money than it’s spending. But if it’s negative, the company is spending more than it’s making. It’s like a company’s financial cushion to handle day-to-day expenses.

Cash flow management is super important because it keeps the business running. The money coming in has to cover the costs and can also be used for investments. So, the cash flow statement shows us how much cash the company had over the year and how financially stable it is.

You can easily calculate your cash flow with the simple formula:

- Cash Flow = Earnings – Expenses

Alternatively, one can derive operating cash flow from essential data extracted from annual financial records:

- Operating cash flow = Net profit + expenses without actual cash transactions – alterations in working capital

This method indirectly calculates how much cash a business generates from its profits by removing the items that aren’t actual cash and adjusting for changes in the working capital.

Remember, your business can never grow faster than your Cash Flow allows.

What is Working Capital?

Working capital management is crucial as working capital indicates a company’s ability to meet its short-term obligations.

Working capital can be positive or negative like a person’s bank account balance. A positive working capital means a company has enough current assets (like cash, accounts receivables, and inventory) to cover its current liabilities (like accounts payables, wages, and short-term loans). On the other hand, a negative working capital suggests that current liabilities are higher than current assets, which could be a cause for concern.

To calculate working capital, you can use the following formula:

Working Capital = Current assets (cash + cash equivalents + accounts receivables + inventory) – Current liabilities (accounts payables + wages + short-term loans)

How are Working Capital and Cash Flow Related?

Well, working capital and cash flow are like the “Jay” and “Viru” of your business.

If your working capital management strategies are not efficient, then there is no cash. The same goes with the cash flow; if there is no cash flow management, then there is no working capital to run the operations.

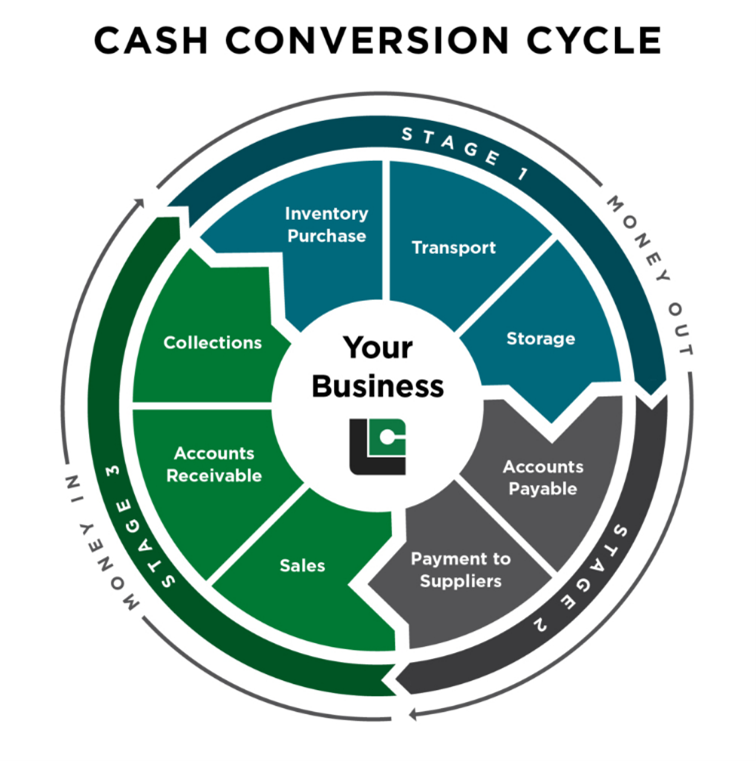

The timeline in which working capital is measured is called the Cash Conversion Cycle (CCC).

Now, every business’s cash conversion cycle is made up of three elements:

- Inventory

- Payables

- Receivables

The time in which you complete all three and convert it into your bank account is the cash conversion cycle. The less the cash conversion time, the more profit in your pocket.

Optimising the Cash Conversion Cycle

It is important for companies to regularly evaluate their CCC and implement working capital management strategies. Why is this? As reducing the cash conversion cycle improves liquidity, enhances working capital management, reduces financing costs, increases profitability, mitigates risks, enhances competitiveness, and boosts stakeholder confidence. By shortening the time it takes to convert inputs into cash, companies can free up capital, respond more effectively to market dynamics, and demonstrate operational efficiency, ultimately contributing to their long-term success and sustainability.

So, what are some ways you can optimise your Cash Conversion Cycle?

- Optimize inventory levels: Ensure excess cash is not tied up in unsold goods or stockouts that can lead to lost sales.

- Implement just-in-time (JIT) inventory practices: JIT inventory management aims to minimize inventory holding costs by only ordering or producing goods as they are needed.

- Shorten credit terms for customers: Reducing the time customers have to pay for goods or services can improve cash inflows.

- Offer discounts for early payment: Providing incentives such as discounts for early payment can encourage customers to settle their invoices promptly, thereby reducing the average collection period. This tactic can help free up cash for the business and improve liquidity.

Genuine Parts Company: King of CCC

Let’s take the case of Genuine Parts Company!

Founded in 1928, Genuine Parts Company (GPC) is known for its competitive automotive and industrial parts business. Faced with the challenges of the global pandemic, GPC sought to enhance its working capital management strategies across its operations in North America, Europe, and Australasia.

Recognizing the financial struggles of its suppliers, GPC, a longtime user of supply chain finance, reevaluated its approach to provide additional support during these unprecedented times.

The company reduced its working capital cycle by 92%, from 133 days to 11 days.

But how!?

The company has made a positive shift in its Days Payable Outstanding (DPO), increasing from 39 days to 135 days since the introduction of its new supply chain finance strategy.

Furthermore, the company’s Cash Conversion Cycle (CCC) showed a remarkable improvement, decreasing by 92% from 133 days to 11 days. These enhancements continued, particularly during the global pandemic.

On the supplier front, the company extended supply chain finance, to provide suppliers with increased opportunities to secure cost-effective capital.

However, it is important to understand that it is not a ‘one size fits all’ approach. What worked for GPC may not necessarily work for your business.

Usually, entrepreneurs resort to the same solutions the moment they come across a crisis – bank lending or a halt in operations. However, effective solutions which are specific to each business exist and these are often more rewarding with less of a risk!

Are you looking for customised solutions to help you optimise your working capital management strategies, leading to released cash in turn leading to capitalising on growth opportunities?

Look no further!

At Contetra, we have worked with over 150 business owners to help them create legacy businesses with a sustainable growth plan and effective working capital management strategies.

So, what are you waiting for? Set up a FREE business review call today for a growth tailored specifically for your business with one of our Business Strategy and Growth consultants –