Do you know how many times you have had coffee at your office, or the number of times you’ve had lunch at the office or availed any of your employee benefits? No Right!

Well, this number is slightly not relevant for a smaller organisation with 50-100 employees.

However in large corporations, with around 10,000+ employees, the cost of serving coffee/lunch every day becomes highly relevant.

And this goes beyond all the employee benefits availed to the employee, during his/her tenure.

Then how do they calculate such employee benefits on a continual basis? Because these costs/benefits, whether small or large are going through the org’s wallet.

The answer is Ind AS 19 – Employee Benefits.

What Does the Standard Say?

Employee Benefits – Ind AS 19 prescribes the accounting guidelines for all types of employee benefits availed to employees during their tenure. These benefits can be anything including pensions, insurance, bonuses, or even paid leaves.

However, Ind AS 19 does not recognize any benefits availed via share-based payments, that go under IFRS 2.

Why Do We Need Ind AS 19?

Can’t it be covered as petty expenses or any other expense?

Employee benefits are like promises made by the organisation to the employee today, which are to be paid in the future.

For example, a gratuity is paid to an employee after he/she completes a certain period, which was discussed during the interview.

Here, the amount of gratuity is promised to be paid in the future. So every year, a certain amount will be added to the gratuity account of the employee, which is likely to be paid after a few years.

This annual transaction is a liability for the organisation and hence can’t be considered as an expense.

Similarly, every employee benefit is a liability for the organisation, which was promised to be availed for the employees.

IAS 19 – employee benefits mandates that a company must record:

- A liability when an employee has worked in return for future benefits; and

- An expense is when the company uses the economic value of the work done by an employee in exchange for these benefits.

How is Ind AS different from IGAAP?

Well, as per both previous GAAP and Ind AS recognised costs related to its post-employment defined benefit plan on an actuarial basis.

Under Previous GAAP, the entire cost, including actuarial gain and losses, was charged to the statement profit or loss.

Note: Actuarial gains or losses refer to the differences between an employer’s pension payments and the expected costs.

While, under Ind AS, remeasurements of these costs (comprising of actuarial gains and losses, the effect of assets ceiling, excluding amounts included in net interest on the net defined benefit liability and return on plan assets excluding amount included in net interest on the net defined benefit liability) are recognised in Other Comprehensive Income (OCI), which is covered under Balance Sheer under the head of shareholder’s equity.

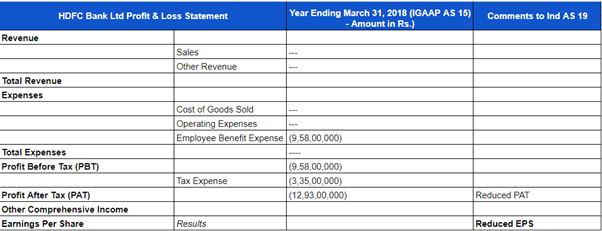

Let’s understand better with the help of an example of one of India’s leading housing finance companies, HDFC Ltd.

While drafting the financials for the year ending on March 31, 2018, HDFC Ltd. grouped the Employee benefit expenses of Rs. 9.58 crore as an expense under the profit and loss statement.

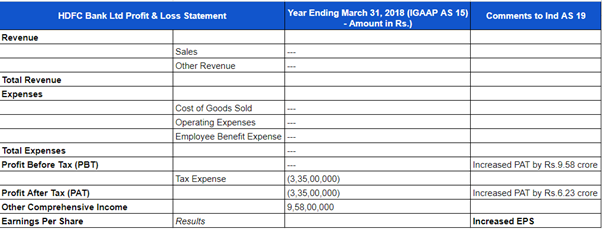

However, as per the adjustments under Ind AS 19, the Employee Benefit Expenses will be grouped under OCI.

Thus, employee benefit expense is adjusted by Rs. 9.58 crore and is recognised in OCI for the year ended March 31, 2018. The above change does not affect total equity as of March 31, 2018. However, profit before tax and profit after tax for the year ended March 31, 2018, increased by Rs. 9.58 crore and Rs. 6.23 crore respectively.

Financial Metric | IGAAP | Ind AS | Change |

Employee Benefit Expense | Charged fully to Profit or Loss | Adjusted by Rs. 9.58 crore and recognized in OCI | Rs. 9.58 crore less in P&L, recognized in OCI |

Profit Before Tax (PBT) | No adjustment for actuarial gains/losses | Increased by Rs. 9.58 crore due to shift of actuarial gains/losses to OCI | Increased by Rs. 9.58 crore |

Profit After Tax (PAT) | No adjustment for actuarial gains/losses | Increased by Rs. 6.23 crore (net of tax effect of adjustments moved to OCI) | Increased by Rs. 6.23 crore |

Tax Impact | Included in the statement of Profit or Loss | Regrouped to OCI, amounting to Rs. 3.35 crore | Rs. 3.35 crore moved to OCI |

Impact on Total Equity | None directly mentioned | No change in total equity as at March 31, 2018 | No change |

**Note: This example has been simplified with no additional numbers for better understanding.

What Type of Benefits Can Be Covered Under Ind AS 19 – Employee Benefits?

As defined earlier, all the employee benefits from the start to end of the employment are covered. As per Ind AS 19, there are 4 broad types of benefits which can be accounted for, under the standard:

- Short-term Benefits: These cover wages, salaries, paid annual leave, and sick leave, profit-sharing, and bonuses anticipated to be settled within 12 months after the employees render the service.

- Post-employment Benefits: This category includes pensions or other retirement benefits, classified into defined contribution plans and defined benefit plans—the latter requiring intricate actuarial valuations to account for future liabilities.

- Other Long-term Benefits: These benefits include long-service leave or sabbatical leave, jubilee or other long-service benefits, long-term disability benefits, and deferred compensation payable 12 months or more after the end of the period in which employees render the related service.

- Termination Benefits: These include redeemable leaves or severance pay which are payable because of either an employer’s decision to terminate an employee’s employment before the normal retirement date or an employee’s decision to accept voluntary redundancy in exchange for these benefits.

And that wraps up everything you need to know about Ind AS 19!

This standard lays down the rules for accounting for employee benefits and ensuring fair treatment. Ind AS 19 – employee benefits not only is a compliance measure but also, a tool to ensure better financial transparency.

Ready to streamline your company’s financial reporting with Ind AS 19?

Look no further!

At Contetra, we work with CFOs and senior finance leaders to make reporting smoother. Our team of Chartered Accountants can help you understand and apply global standards.

Visit our page to learn more about how we can assist you: Contetra – Technical Accounting & International GAAP Advisory Services.