Last year on June 1, 2023 in the UAE Corporate Tax was introduced and it changed the entire scenario of UAE’s tax status. So, what does this mean for the business?

Well, the answer is simple actually, it only applies to businesses with an income/revenue exceeding AED 375,000. A standard tax rate of 9% is applicable on businesses exceeding the threshold amount. Rest, 0% rate for taxable income below that threshold.

This change is pivotal for SMEs in the UAE, which are now required to comply with these new regulations.

But how do the businesses account for the income? Since the companies did not have to pay taxes, no accounting standard was implemented.

To standardise the accounting practices in the UAE, businesses will now have to implement IFRS for SMEs.

Which companies have to comply with the IFRS?

- Companies listed in UAE must release financial statements in accordance with IFRS guidelines.

- Similarly, financial institutions like banks and NBFCs in the United Arab Emirates are also obligated by the Central Bank of the UAE to disclose their financial statements following IFRS standards.

IFRS is a comprehensive accounting practice which is sometimes tricky to comply with for small businesses. To make this compliance simpler for SMEs, we have IFRS for SMEs, a much-simplified version of IFRS.

Recently, FTA released a guide regarding the IFRS and Corporate tax; we’ve summarised the key pointers:

- Accounting Standards and Methods: Under the UAE Corporate Tax law, businesses are required to use IFRS for SMEs to calculate taxable income. For SMEs whose revenue does not exceed AED 50 million, the IFRS for SMEs is applicable.

- Tax Grouping and Financial Reporting: In the case of tax grouping, consolidated financial statements must be prepared, eliminating transactions between group entities. If a Tax Group’s revenue exceeds AED 50 million, its consolidated financial statements must be audited.

- Cash Basis of Accounting: SMEs with revenue not exceeding AED 3 million can apply cash basis accounting without needing to submit an application to the Federal Tax Authority (FTA). However, once the revenue exceeds AED 3 million, financial statements must be prepared on an accrual basis, except under exceptional circumstances with FTA’s approval.

So, how will the UAE Corporate Tax and IFRS for SMEs interact?

Let’s understand better with the help of a hypothetical case study:

Company Profile:

– Name: UAE Manufacturing Co. (UMC)

– Industry: Manufacturing

– Scenario: UMC is a medium-sized manufacturing company operating in the UAE, primarily engaged in producing electronics and appliances.

IFRS Considerations:

- Revenue Recognition (IFRS 15): UMC adopted IFRS 15, which governs how it recognizes revenue from sales of its products. Compliance with this standard ensures that revenue is recognized when control of goods transfers to customers. This impacts how UMC reports sales and revenue in its financial statements.

- Asset Valuation (IFRS 16): UMC leases several production facilities and machinery. The adoption of IFRS 16 changes how these leases are accounted for, moving them from operating leases to finance leases. This affects the recognition of assets and liabilities on the balance sheet, impacting the company’s financial ratios.

- Tax Planning: UMC’s financial team works closely with tax advisors to optimize its tax position. For example, they assess the impact of depreciation on assets under IFRS 16 on the company’s taxable income and calculate the applicable depreciation expense for tax purposes.

Corporate Tax Considerations:

- Corporate Tax Introduction: The UAE corporate tax at the rate of 9%, will be applicable to UMC and other companies in the manufacturing sector. UMC must ensure compliance with this new tax law.

- Tax Exemptions: UMC can explore tax exemptions available under the new corporate tax regime, particularly those related to investment in research and development (R&D) for innovative products, as encouraged by the government.

- Transfer Pricing (TP) Rules: If UMC is part of a larger international group with related-party transactions. The company must adhere to UAE’s transfer pricing regulations to ensure that transactions between group entities are conducted at arm’s length prices. Compliance with these rules helps in avoiding tax disputes.

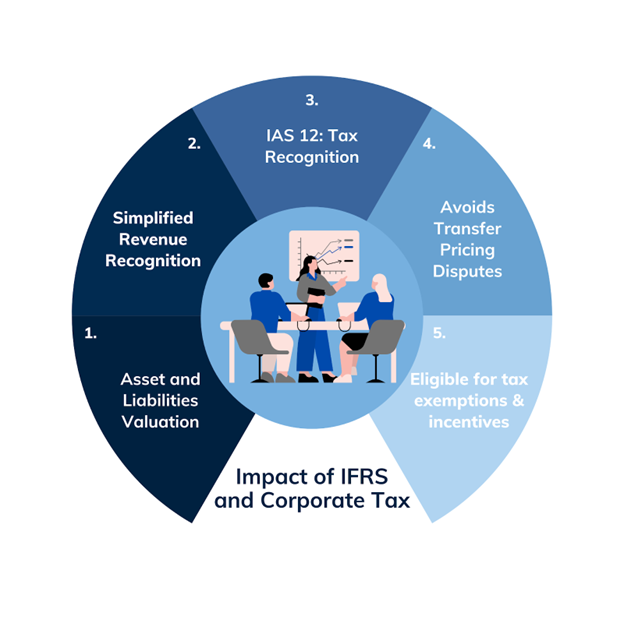

Impact of IFRS and Corporate Tax:

– UMC’s adoption of IFRS 16, which involves recognizing assets and liabilities differently, directly impacts the company’s financial statements. This, in turn, affects its taxable income and depreciation calculations for corporate tax purposes.

– UMC’s adoption of IFRS 16, which involves recognizing assets and liabilities differently, directly impacts the company’s financial statements. This, in turn, affects its taxable income and depreciation calculations for corporate tax purposes.

– The revenue recognition policies under IFRS 15 impact the timing of recognizing sales revenue in UMC’s financial statements. This may have indirect implications for corporate tax due to the timing of taxable income recognition.

– IAS 12 under IFRS uses a comprehensive balance sheet method for income taxes, covering current and deferred tax, based on assets and liabilities’ future recovery or settlement.

– Compliance with transfer pricing rules under IFRS and corporate tax is essential to avoid tax disputes and penalties. UMC ensures that its related-party transactions are documented and priced according to the regulations.

– UMC leverages its financial reporting under IFRS to assess its eligibility for tax exemptions and incentives offered by the government, such as R&D credits.

It’s important to note that while the adoption of IFRS for SMEs can provide potential tax benefits, the exact impact on a company’s tax position will depend on various factors, including the specific provisions of the UAE’s tax laws, the company’s business activities, and its financial performance.

Therefore, it’s advisable for companies to consult with tax professionals and financial advisors who are well-versed in UAE tax regulations and IFRS for SMEs to assess the specific tax advantages that may apply to their situation.

Wondering about the impact on your profits and business valuation? Seeking a partner to implement IFRS for your business?

Your search ends here!

At Contetra, we collaborate with CFOs and senior finance leaders to streamline financial reporting, creating statements that resonate in a global context.

Visit our page to know more about how our team of Chartered Accountants can help ease your financial reporting burden! – https://contetra.com/technical-accounting-international-gaap-advisory-services/