While it is a general perception in the financial world that IFRS 9 – Financial Instruments could result in volatility in reported income of many companies (on account of assets being measured at fair value, and resulting change being reflected in the statement of profit and loss) – there is another significant impact of this standard on the “leverage” ratio on the financial statements of many companies.

What is leverage and leverage ratio?

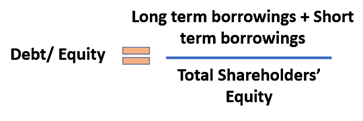

In business terms, leverage means debt i.e., external fund (Borrowing) can be “leveraged” to increase the returns of a company. One of the most important leverage indicators (the Debt-to-Equity ratio) essentially shows the proportion of a company’s funds sourced from debt and how much are sourced through owners’ equity.

What is an optimal Debt-to-Equity ratio?

Exactly how much debt is ideal for a business depends on the company’s requirements from time to time and the company’s nature of operations.

For instance, capital-intensive industries such as manufacturing commonly have higher levels of debt than say, a company operating in the service industry such as Information Technology industry.

A classic example of the above: The Debt-to-Equity ratio of Tata Motors as of 31 March 2021 was 2.08 times (meaning debt is twice the amount of shareholder capital). Since the company is an automobile manufacturer requiring heavy infrastructure generally requires higher debt to fund the purpose of operating assets. As the borrowings are backed by capital assets a leverage of more than 2 times would not be so alarming.

In contrast, the Debt-to-Equity ratio of Tata Consultancy Services is 0, despite being a part of the same group of companies (Tata Sons). This proves that what is regarded as a healthy Debt-to-Equity ratio will vary from industry to industry and business to business!

An interesting point to consider here is: Do you think TCS is over-relying on equity funding? Let me know in the comments!

How one of the biggest Indian conglomerates aspires to become a debt-free company!

In a bold (and boastful?) move, Reliance Industries Ltd. chairman Mukesh Ambani declared in July 2020 that RIL had ambitions to become Net Debt-free! Which essentially meant the company had enough cash and marketable securities to pay off its existing debt.

To that end, the company repaid more than USD 21 Billion of its debt after raising over USD 44.4 billion of capital (including noteworthy investors like Facebook and Google’s acquisition of around 18% stake in Jio worth USD 10.2 billion), which was the largest ever capital raised by any company in a year globally.

This resulted in a decrease of more than 35% in the debt-to-equity ratio from 0.65 in March 2020 to 0.41 in March 2021!

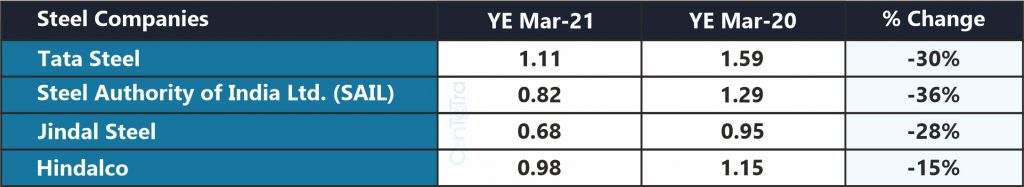

A Major wave of Deleverage in the Steel Industry!

Another recent example of de-leveraging: While an increase in global steel prices might have been a cause of concern for end-consumers, it was a dream run for the major steel players in India, who went on a de-leveraging spree – managing to pay off a whopping 15% to 35% of their total debt by taking advantage of the global price rise! The below table illustrates the considerable decrease in Debt-to-Equity ratio for this capital-intensive industry:

Why is the Debt-to-Equity ratio an important financial metric?

- The debt-to-equity ratio is often used while applying for a business loan or line of credit. Banks will take an account of the industry’s average ratio and compare the same with the company’s debt equity ratio to determine the credibility of the business.

- For investors, the debt-to-equity ratio is used to indicate how risky it is to invest in a company.

Generally, the higher the debt-to-equity ratio, the riskier the investment since it indicates that the company already has a significant amount of debt – however this must be assessed in conjunction with the industry standard.

- It can help lenders to ascertain on whether to impose a debt covenant on the borrower i.e., (placing restrictions on the overall borrowing limits of the borrower while lending them money) – Often these limits are monitored by the debt-to-equity ratio.

Now that we have understood the significance of Debt-Equity ratio, let’s understand how IFRS and its principle of “substance over form” can impact the leverage ratio even without raising any additional capital!

How a major entertainment conglomerate’s Debt Equity ratio was adversely impacted after adopting IFRS 9?

Pre-Ind AS Scenario:

The said entertainment conglomerate had in its balance sheet “redeemable preference shares” which are preference shares issued to shareholders having a callable option implanted by default. This implies that the company can repurchase this class of shares against cash from the shareholders at the end of a fixed term.

The price at which a company can repurchase these redeemable preference shares is already decided at the time of issuing such shares.

Before the adoption of Ind AS (Converged IFRS), Redeemable preference shares were classified and accounted in the Financial Statements under “Equity”.

Impact of IFRS 9: In 2015, post the first-time implementation of Ind AS / IFRS, the media conglomerate (Zee Entertainment) had to classify their Redeemable Preference Shares as Debt which adversely impacted their Debt Equity ratio (leverage) by 0.6 times (vs. 0 times)!

This is because as per IFRS 9, Compulsorily Redeemable Preference Shares contain an “Obligation to pay” and therefore had to be classified as debt in the Financial Statements!

As a stakeholder, this would also mean that the Preference share dividend would now be recognized as an interest expense in the Statement of Profit & Loss instead of being an appropriation out of profit as was the case earlier.

What ‘Substance over Form’ principles would be taken into consideration in determining if Preference shares are Debt or Equity?

- Are the preference shares redeemable at a fixed date?

- Does the option to redeem held by the holder of the shares?

- Are the payments to be made (whether as interest or dividends) mandatory for the issuer?

- Whether a specific percentage of profit obligated to be distributed to the holders?

When the answer to the above questions is yes, the preference shares would be recognized as a Financial liability (Debt) as per IFRS 9. This is because the issuer has a definite obligation of delivering a financial asset or cash to the holders of the instrument. However, if the answers to the above questions are mixed, then the classification would vary from case to case.

Put on Your Thinking Cap!

After understanding the implications of IFRS 9 on debt-equity ratios, I hope you will now be able to assess:

- Whether such class of Preference shares exist in your organization?

- Whether you have classified it accordingly?

- If classified correctly, whether you have been accounting for it appropriately?

- Did such a reclassification impact your company’s leverage ratio?

I would love to discuss these in detail with you at my 2.5 hours breakthrough webinar where I “practically decode Financial Instruments Using ECL Template” and get to the Business-impact of IndAS/ IFRS using real-world case studies! Register for the workshop here. (Limited seats only)

Thank you so much for sharing the article. It is worth reading.

Thank you for sharing valuable information.