Cash to your business is what Oxygen is to our body. It is essential for the business to breathe and thrive. Many business-owners mistake Cash Flow for Net Profit. But cash flow is NOT net profit!

As mentioned in the second blog of the series (check it out here), Net Profit is merely the remains of the revenue over the expenses. Cash Flow is what really gives you the resources to expand your business, hire more team members and achieve your company’s strategic goals.

Cash Flow helps your business function. You cannot “spend” Net profit or Assets. All you can spend is cash.

Your Growth Limiter

It’s a frequent occurrence for small and medium scale enterprises that are growing rapidly to experience a very tight cash flow or constrained working capital. The reason is simple.

When businesses grow rapidly, significant investments into assets, employees, inventory, and accounts receivables (by offering more lucrative payment terms to customers) need to be made consistently to increase growth. The only problem with this is all these investments suck up a huge chunk of cash very quickly.

The natural tendency of business owners to focus on sales growth rather than net profit leads to them not monitoring things like accounts receivable and inventory which eventually sneaks up and leads to unnecessary tight cash flow for the business and needless stress and pain for the owner.

Owning and running a money-making business requires the business owner to balance Net Profit, Return on Investment and Cash Flow. The goal must be to keep all of them in balance.

Always remember, your business can never grow faster than your Cash Flow allows.

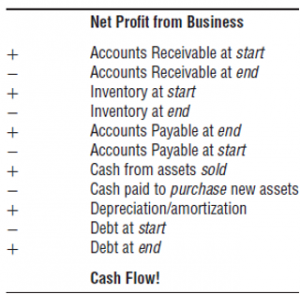

The Cash Flow Formula

Giving a close look to the formula, you will find why is it that even though your business is earning a nice and steady net profit, it is still starving for cash.

Net Profit is just the starting point. There are an awful lot of things that happen to that net profit while it travels and ultimately becomes your cash flow.

And hence, there are two different things you need to pay attention to – Your Net Profit and Cash Flow. We have observed in our numerous years of expertise that most business owners do not pay attention to the cash flow formula. The sole reason for this is that they don’t realize what exactly controls their cash flow, i.e, the elements of this formula. And to your surprise, it is a very fixable problem.

Want a quick hack to improve your cash flow immediately? Send invoices early!

80-90% of business owners do not have a system to process their invoices. Hence, they lose track of which invoice is sent to customer and which is pending. In addition to setting this process right, finance teams must also ensure monthly statements of account are sent to customers in addition to actual invoices.

So, this is a classic example of a very simple activity that your business can change, which will have a large positive impact on your cash flow!

Who can imagine a world without Apple?

But the world was about to witness the downfall of the iconic company in the late 90s – all because of cash flow woes! The company almost went bankrupt after losing over $1 Billion in an expansive line of products that were not sustainable by the company’s cash flow. Miraculously, it survived with the help of a $150 Million investment from its biggest competitor Microsoft! By 2003, Microsoft had sold its entire stake in Apple for $550 million. Can you imagine Bill Gates regret of missing out on $159 BILLION by selling the stock way too early?!

Anyway, I digress. Apple realized its mistakes when it came to administering cash flow, and look at it now. In Sept 2018, Apple started its financial year with around $26 billion in cash and ended with over $50 billion by Sept 2019!

As amazing as it sounds, remember they were also stuck tightly in cash problems, prior to getting outside help. So in case you are also stuck in a similar cash strangle, we’re just a call or email away.

Set up a non-chargeable call with our team of strategic consultants who will give you effective solutions with the help of our PCV Simulator!

Feel free to book a slot here for a personal one-to-one review: https://calendly.com/reachout-_g/30min?month=2023-09

Thanks for the sharing knowledge with us & This is Very useful in all the small and medium enterprises.

Because every business owner need a profit on books of account but they are forgetting it’s not surviving them in market. Some Competitors are waiting for this they are tracking all your activities.

To the contetra.com owner, Your posts are always well-supported by facts and figures.

Hi contetra.com administrator, Your posts are always well-written and easy to understand.

Dear contetra.com webmaster, Good work!

Hi contetra.com administrator, Thanks for the well-organized and comprehensive post!

Hi contetra.com admin, You always provide great examples and real-world applications.